The Money Thread...

-

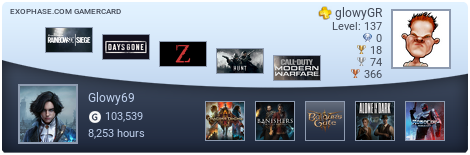

Glowy69

- Member

- Joined in 2008

- Location: B6

- Minto

- Member

- Joined in 2009

- Location: Belfast, Northern Ireland!

PSN: MintKorp - NNID: Mintoisking

-

Glowy69

- Member

- Joined in 2008

- Location: B6

-

Glowy69

- Member

- Joined in 2008

- Location: B6

- Grumpy David

- Member

- Joined in 2008

- AKA: Cubeamania

- Grumpy David

- Member

- Joined in 2008

- AKA: Cubeamania

- Death's Head

- Member

- Joined in 2009

Yes?

- Death's Head

- Member

- Joined in 2009

Yes?

- Death's Head

- Member

- Joined in 2009

Yes?

- Death's Head

- Member

- Joined in 2009

Yes?

Who is online

Users browsing this forum: Benzin, Edd, Garth, Kanbei, poshrule_uk, Rawrgna, The Watching Artist, TonyDA, Trelliz, Zaichik and 588 guests