The Money Thread...

-

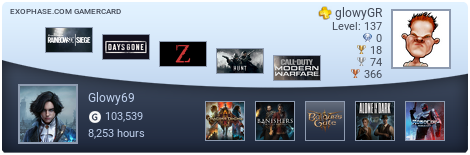

Glowy69

- Member

- Joined in 2008

- Location: B6

- LewisD

- #grcadesangle

- Joined in 2008

- AKA: L3wisD

- Location: Reading, Berkshire

- Contact:

-

7256930752

- Rightey

- Member

- Joined in 2008

Pelloki on ghosts wrote:Just start masturbating furiously. That'll make them go away.

- Andrew Mills

- Guides Sec.

- Joined in 2008

- Location: Cranfield

- LewisD

- #grcadesangle

- Joined in 2008

- AKA: L3wisD

- Location: Reading, Berkshire

- Contact:

- Grumpy David

- Member

- Joined in 2008

- AKA: Cubeamania

-

Glowy69

- Member

- Joined in 2008

- Location: B6

-

Glowy69

- Member

- Joined in 2008

- Location: B6

- LewisD

- #grcadesangle

- Joined in 2008

- AKA: L3wisD

- Location: Reading, Berkshire

- Contact:

Who is online

Users browsing this forum: No registered users and 428 guests