The Money Thread...

- Herdanos

- Go for it, Danmon!

- Joined in 2008

- AKA: lol don't ask

- Location: Bas-Lag

Generating Real Conversations About Digital Entertainment

- Grumpy David

- Member

- Joined in 2008

- AKA: Cubeamania

- Herdanos

- Go for it, Danmon!

- Joined in 2008

- AKA: lol don't ask

- Location: Bas-Lag

Generating Real Conversations About Digital Entertainment

- That's not a growth

- Member

- Joined in 2008

- Herdanos

- Go for it, Danmon!

- Joined in 2008

- AKA: lol don't ask

- Location: Bas-Lag

Generating Real Conversations About Digital Entertainment

- RockerShaun

- Member

- Joined in 2014

- Location: Leicester

- That's not a growth

- Member

- Joined in 2008

- Grumpy David

- Member

- Joined in 2008

- AKA: Cubeamania

- Eighthours

- Emeritus

- Joined in 2008

- Location: Bristol

-

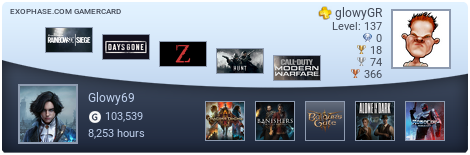

Glowy69

- Member

- Joined in 2008

- Location: B6

- Green Gecko

- Treasurer

- Joined in 2008

"It should be common sense to just accept the message Nintendo are sending out through their actions."

_________________________________________

❤ btw GRcade costs money and depends on donations - please support one of the UK's oldest video gaming forums → HOW TO DONATE ❤

_________________________________________

❤ btw GRcade costs money and depends on donations - please support one of the UK's oldest video gaming forums → HOW TO DONATE ❤

- Drumstick

- Member ♥

- Joined in 2008

- AKA: Vampbuster

Check out my YouTube channel!

One man should not have this much power in this game. Luckily I'm not an ordinary man.

One man should not have this much power in this game. Luckily I'm not an ordinary man.

- Cheeky Devlin

- Member

- Joined in 2008

Who is online

Users browsing this forum: No registered users and 542 guests